Decade of Impact

For 10 years, Moniepoint has powered Nigeria's financial ecosystem.

In Review

For 10 years, Moniepoint has powered Nigeria's financial ecosystem.

OUR JOURNEY SO FAR

For 10 years, Moniepoint has powered Nigeria's financial ecosystem.

For 10 years, Moniepoint has powered Nigeria's financial ecosystem.

Here's what a decade of powering payments across Nigeria looks like.

See our impact!

And it was a milestone year in many ways.

8 out of 10 in-person payments in Nigeria are made on a Moniepoint terminal. 🚀

Moniepoint transfers to Moniepoint terminals are instant!

In over 1 billion transactions made monthly.

And they’re some of the coolest people you’ll ever meet.

To over 70,000 businesses across Nigeria. 🇳🇬

We have disbursed over ₦1 trillion in credit to small businesses.

The top 5 business types receiving credit from Moniepoint.

Provision Stores

Building Materials Sales

Raw Foods

Drinks & Water Wholesales

Supermarkets

Median loan amount

Businesses Funded

Growth in business transaction value after getting a loan

Here's what it means for millions of businesses across Nigeria.

Explore our case studyAcross Nigeria, community pharmacies can now provide access to healthcare through easy payment options and access to credit.

At Onitsha, West Africa's largest Market, Moniepoint supports generational businesses and enables safer, faster trade.

Moniepoint helps farmers and livestock traders in Northern Nigeria collect payments, even in areas far from banks.

Instant settlements, pioneered by Moniepoint in 2019, are critical for 90% petrol stations in Nigeria today.

Across Nigeria, community pharmacies can now provide access to healthcare through easy payment options and access to credit.

At Onitsha, West Africa's largest Market, Moniepoint supports generational businesses and enables safer, faster trade.

Moniepoint helps farmers and livestock traders in Northern Nigeria collect payments, even in areas far from banks.

Instant settlements, pioneered by Moniepoint in 2019, are critical for 90% petrol stations in Nigeria today.

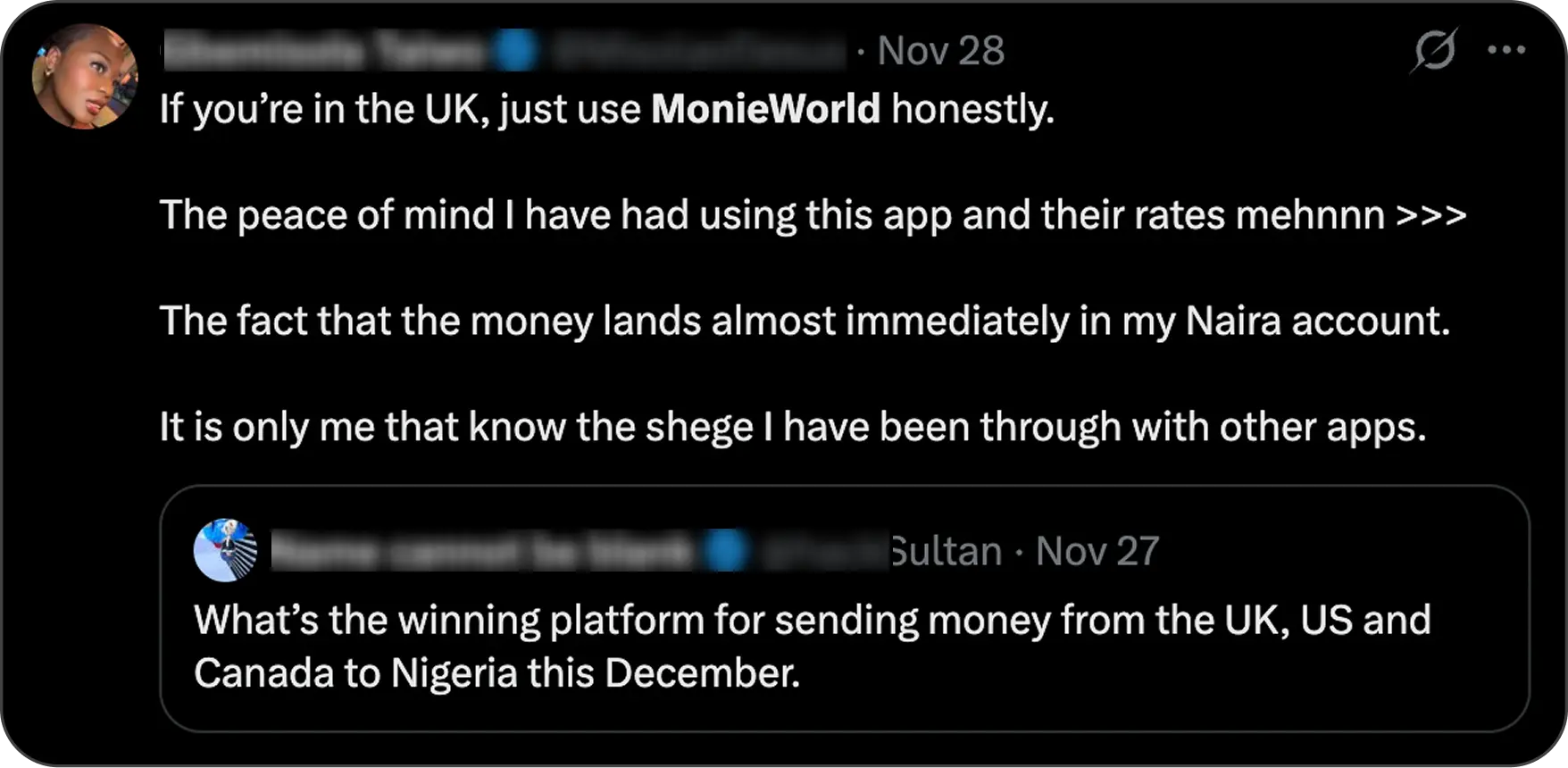

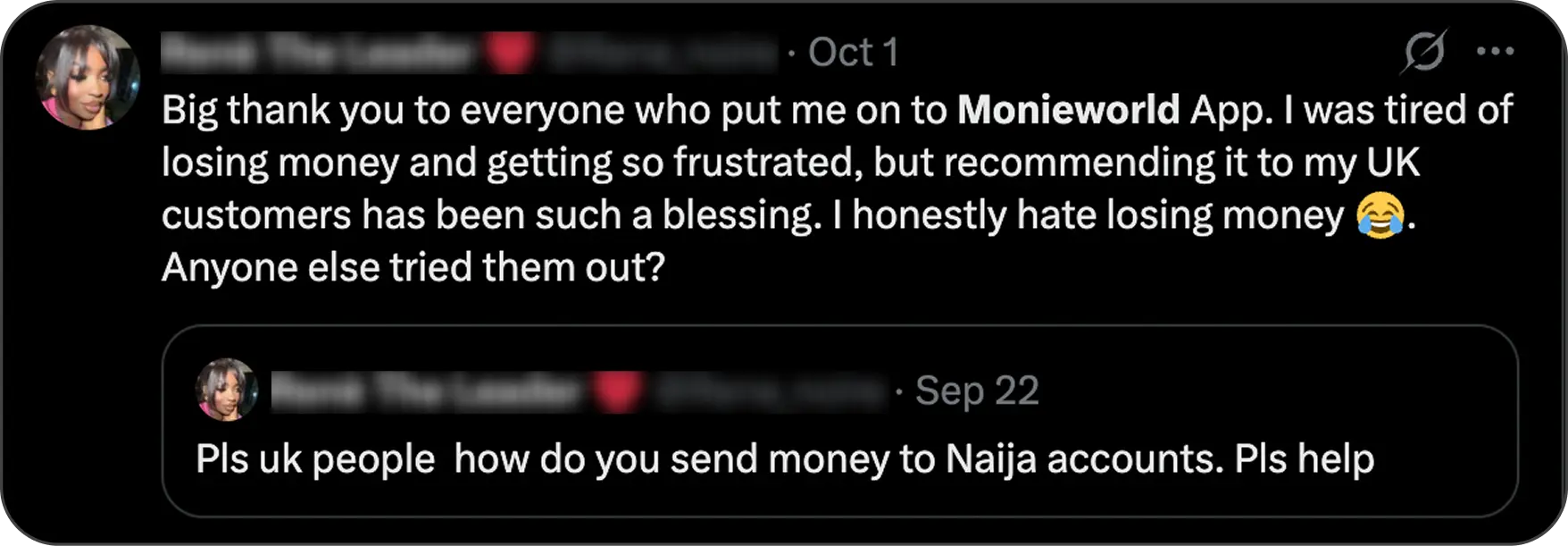

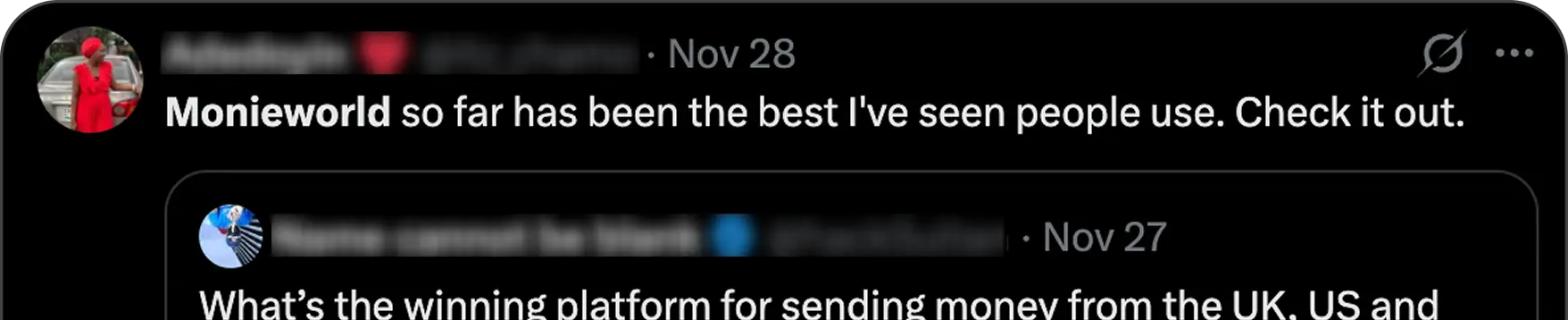

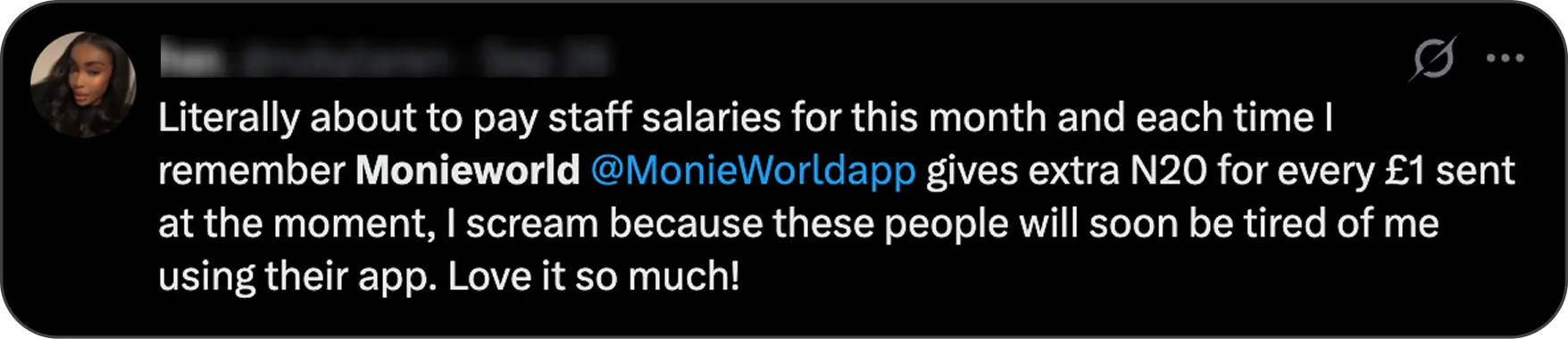

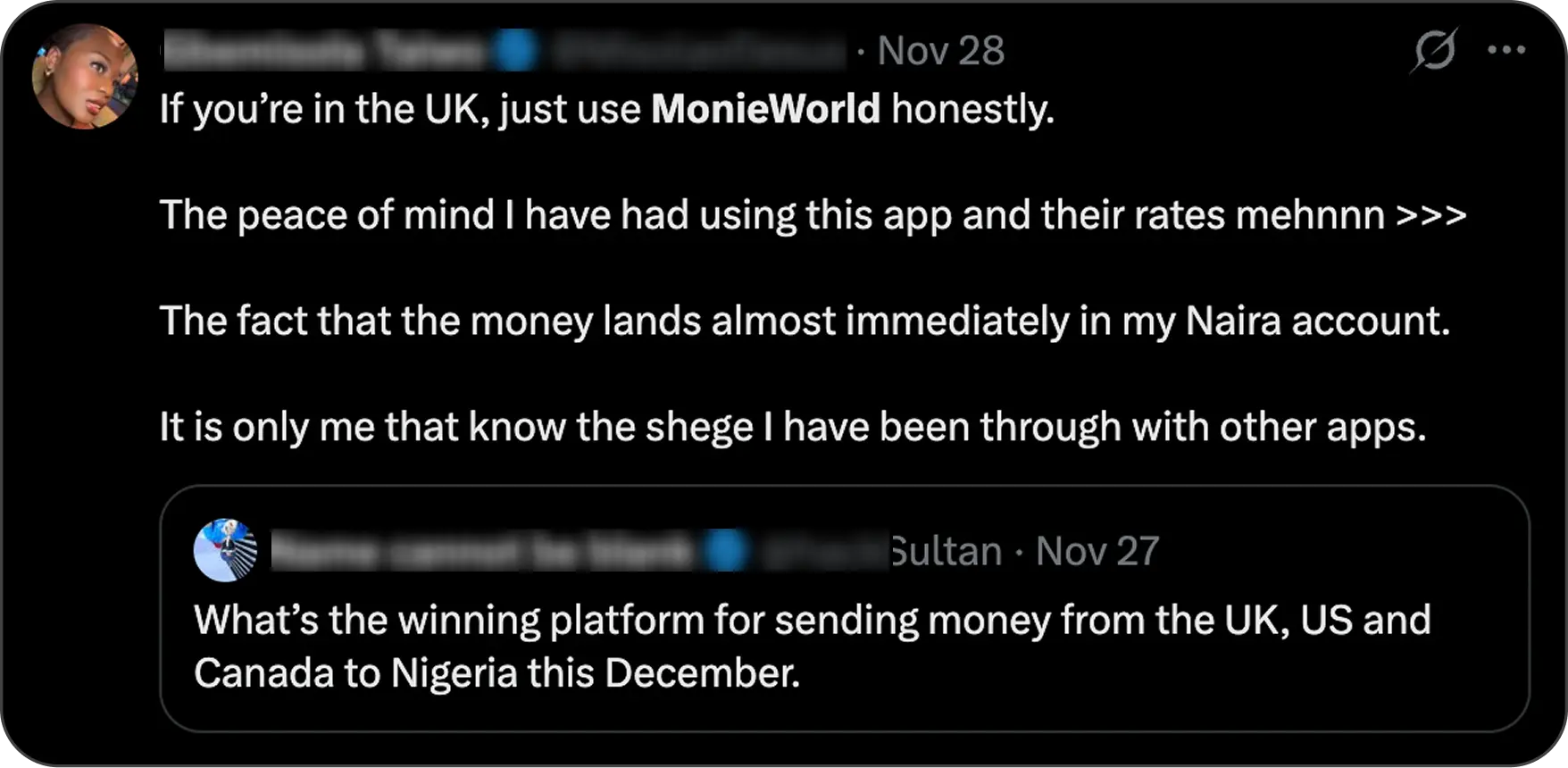

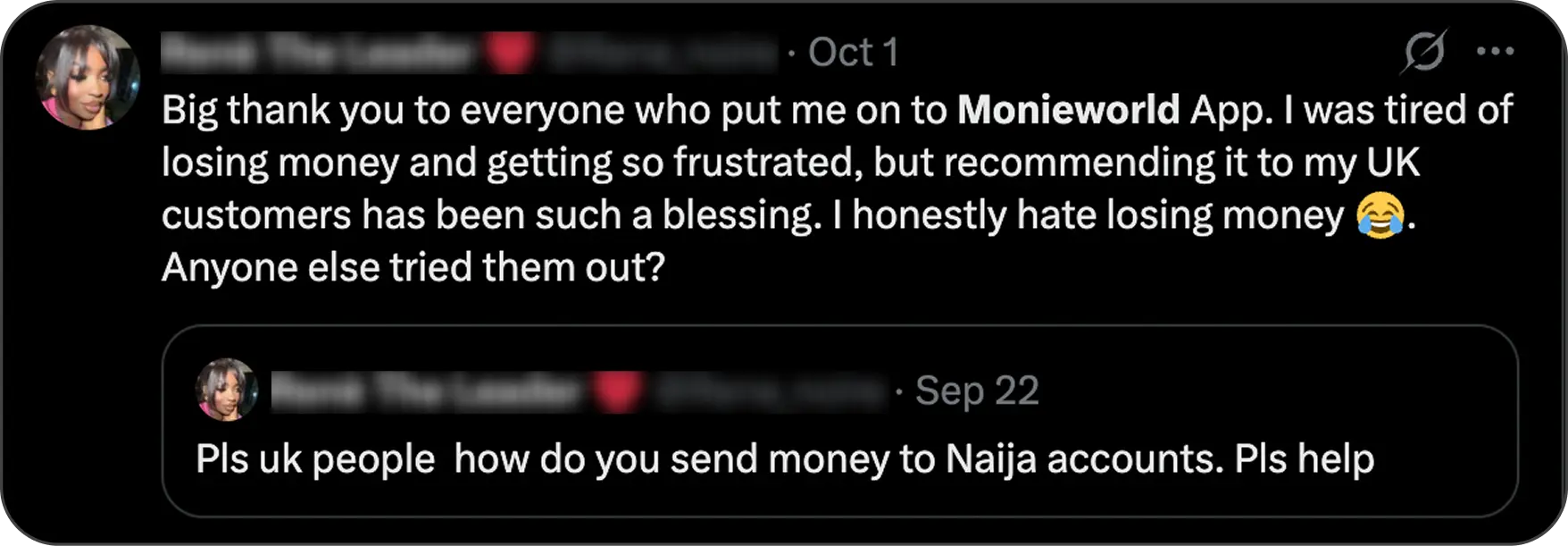

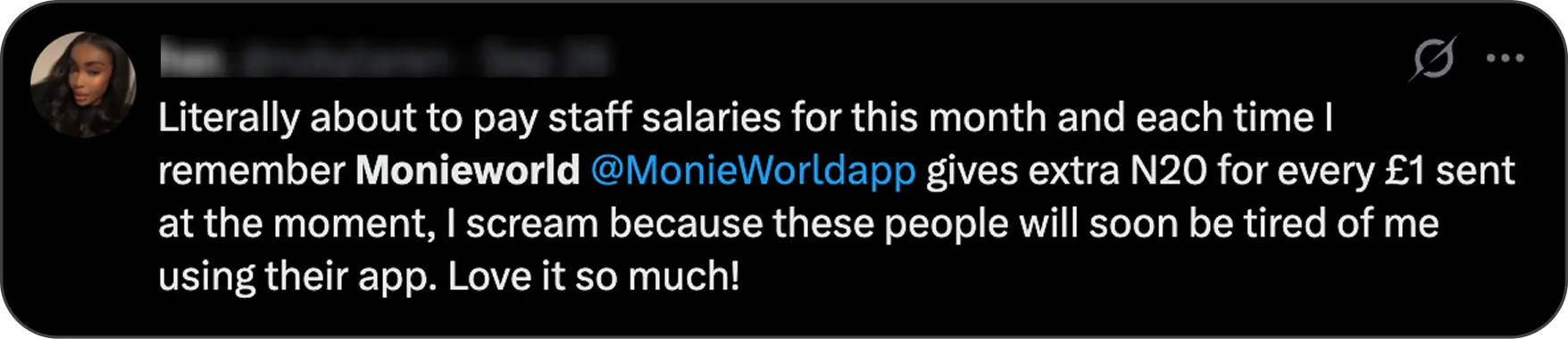

In 2025, we launched MonieWorld our payments solution for Nigerians in the UK.

Our switching subsidiary secured the required certifications from Mastercard and Visa to support international card payments and offer these services to other businesses.

We created a platform for policymakers, regulators, and investors to gain hands-on insight into the Nigeria's informal economy and enable data driven decision-making.

Our all-in-one business management platform. With Moniebook, our inventory management platform, businesses can track sales, inventory, expenses, and profitability on one platform.

See what it can do!

Like a certain yellow brand, our impact is everywhere you go…

Click to explore Moniepoint's impact in your state.

Jan - Dec, 2025

Sokoto, you kept your livestock well cared for. You ranked 2nd highest for Veterinary Drug Stores nationwide.

Click state to explore Moniepoint's impact in your state.

You kept the funds flowing, and we stan. You had the highest average amount per transaction in Nigeria.

The top 5 things nigerians paid for in 2025 were Family Support, Business, Food, Salary / Wages and Utilities.

We relaunched savings in October 2025. Here's how you're stacking up.

The most common target amount between 200k and 500k.

The most common target amount between 200k and 500k.

60% of people who save do so daily

60% of people who save do so daily

The most common reason why people break their savings is because of an emergency

The most common reason why people break their savings is because of an emergencyFrom late‑night spends to everyday essentials, we kept your payments humming in the background so life never had to pause.

16 million Nigerians made successful card payments on Moniepoint every day.

Paid successfully on our POS, with transfers pinging 6,000 times a minute and ₦194 million processed every minute for businesses across Nigeria

Data running low? Nigerians renewed their data plans with Moniepoint over half a million times daily in 2025.

We've now crossed 3,500 DreamMakers across 19 countries. There's a dream maker on 5 of the 7 continents in the world!

DreamMakers

Time 100 Most Influential companies 2025

2025 Financial Times Africa's fastest growing companies

CBN's Financially inclusive fintech of the year

Time 100 Most Influential companies 2025

2025 Financial Times Africa's fastest growing companies

CBN's Financially inclusive fintech of the year

CB's Insight annual fintech 100

CNBC Top Uk's leading fintech firms

IBSI Corporate banking & digital wallets category winner.

CB's Insight annual fintech 100

CNBC Top Uk's leading fintech firms

IBSI Corporate banking & digital wallets category winner.

Want a version of this review you can keep with you?